Founders Equity

Speaking of time and money, let me update you on where your investment in b/log actually stands.

The good news is that since our launch at the beginning of this year, our subscriber base has already grown 1,300%. The bad news is there only are 13 of you subscribing to it.

This leads me to two possible conclusions.

One is that I’ve done a really poor job of convincing others to subscribe, even though I’m giving them potentially valuable equity in it.

The other is that they don’t consider that valuable enough to be worth their time.

I’ll be honest, I haven’t done much to promote it, other than my initial launch column on MediaPost, which didn’t even include a link back to this blog.

But I’ve also included a subscription link at the end of both my personal and professional emails, as well as in my bios on the major social media I use – LinkedIn, Instagram and Twitter – so I’m guessing potentially thousands of people hae seen it and said “meh!”

That’s a little demoralizing, because many of them are friends and family who you’d think would care about what I have to say, especially after making it abundantly clear it’s the most important thing I will ever write.

Well, this story isn’t being written for them. At least not at this point. It’s being written for you and the next subscribers who follow you, until we get to a point that it has real value.

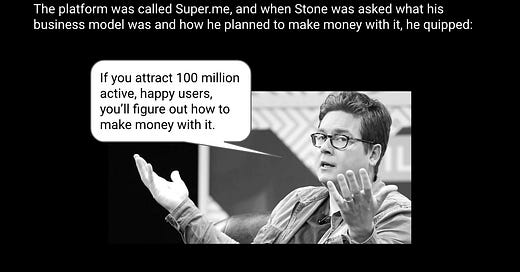

If that doesn’t sound like much of a business plan, I should tell you that I got it from one of Twitter’s founders, Biz Stone, while he was trying to launch another social media platform during the SXSW festival nearly seven years ago.

Needless to say, Super.me never attracted 100 million users, much less active, happy ones. And b/log doesn’t need that many either. But it needs something between 13 and 100 million in order to be viable enough to generate a return on your equity.

I pledge to keep writing it until we do.

In the meantime, I thought there was one more thing I could do to increase the value for the subscribers who help get us to that point. And since all of the equity still is in the form of class “F,” or fictional shares, the only thing I can control at this stage is how many are granted to you.

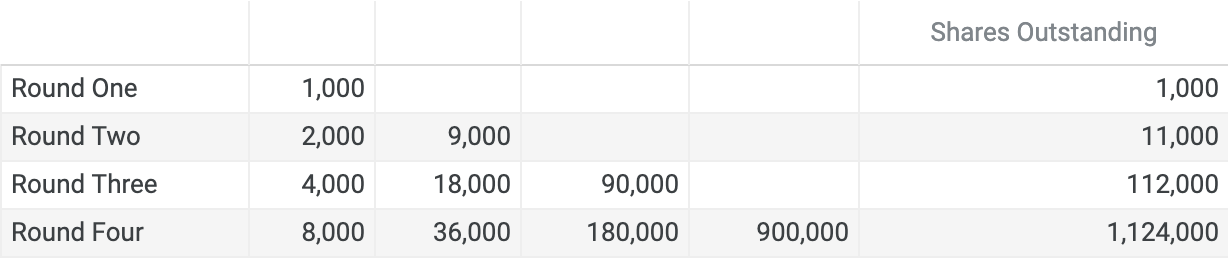

Here’s how the “cap table” will work.

The first 1,000 subscribers will be granted one share of class F stock in this fictional narrative.

The next 9,000 subscribers will be granted one share, and the initial 1,000 readers will receive a two-for-one split.

The next 90,000 subscribers will be granted one share and the preceding 10,000 readers will receive a two-for-one split.

Finally, the next 900,000 who subscribe will be granted one share and the preceding 100,000 readers will receive a two-for-one split.

The class “F” round will close with the 15,000 subscribers and 1,124,000 shares allocated.

What happens from there? To quote Biz Stone, “well figure it out.”

In the meantime, do whatever you can to get others to subscribe and watch your equity grow.